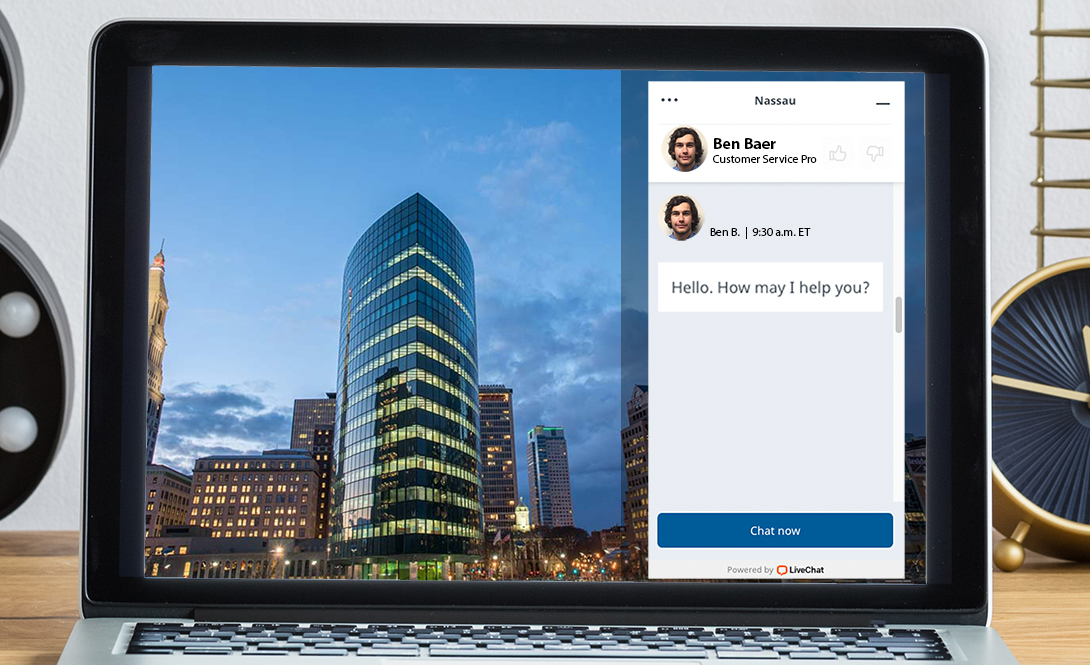

At Nassau, we’re continually analyzing and pioneering new ways to provide you and your clients the best in class service you deserve. We’re excited to announce that we’ve just launched post-issue live chat support for producers.

Here’s How it Works

Currently post-issue live chat support is available Monday through Friday from 8:30-10 a.m. ET for your quick post-issue questions, including assistance on our non-financial, commonly used service forms. To start a live chat conversation, log into your online account on salesnet.nsre.com. A new chat window will automatically pop up on the Forms, Values, and Contact Us pages. If you submit a message, you’ll be connected to one of our customer service pros, who will respond to your inquiry.

We have plans to expand our post-issue live chat support offerings and hours in the future. For instance, back office staff at IMOs can expect live chat support by the end of October. We look forward to your feedback.

Disclosures

For Producer Use Only. Not for use in solicitation or advertising to the Public.

Product features, rider options and availability may vary by state. Actual product details, including all terms and conditions that apply, are contained in the annuity contract. Product sales must be appropriate based on a comprehensive evaluation of the customer’s financial situation, needs, and objectives. Lifetime payments and guarantees are based on the claims-paying ability of the issuing company.

Annuities are issued by Nassau Life and Annuity Company (Hartford, CT). In California, Nassau Life and Annuity Company does business as “Nassau Life and Annuity Insurance Company.” Nassau Life and Annuity Company is not authorized to conduct business in MA, ME, MN, and NY, but that is subject to change. In New York, annuities are issued by Nassau Life Insurance Company (East Greenbush, NY). Nassau Life and Annuity Company and Nassau Life Insurance Company are subsidiaries of Nassau Financial Group. The insurers are separate entities and each is responsible only for its own financial condition and contractual obligations. BPD40345

Insurance Products: NOT FDIC or NCUAA Insured | NO Bank or Credit Union Guarantee.

© 2020 Nassau

NASSAU SALES NEWS

NASSAU SALES NEWS

Recent Comments