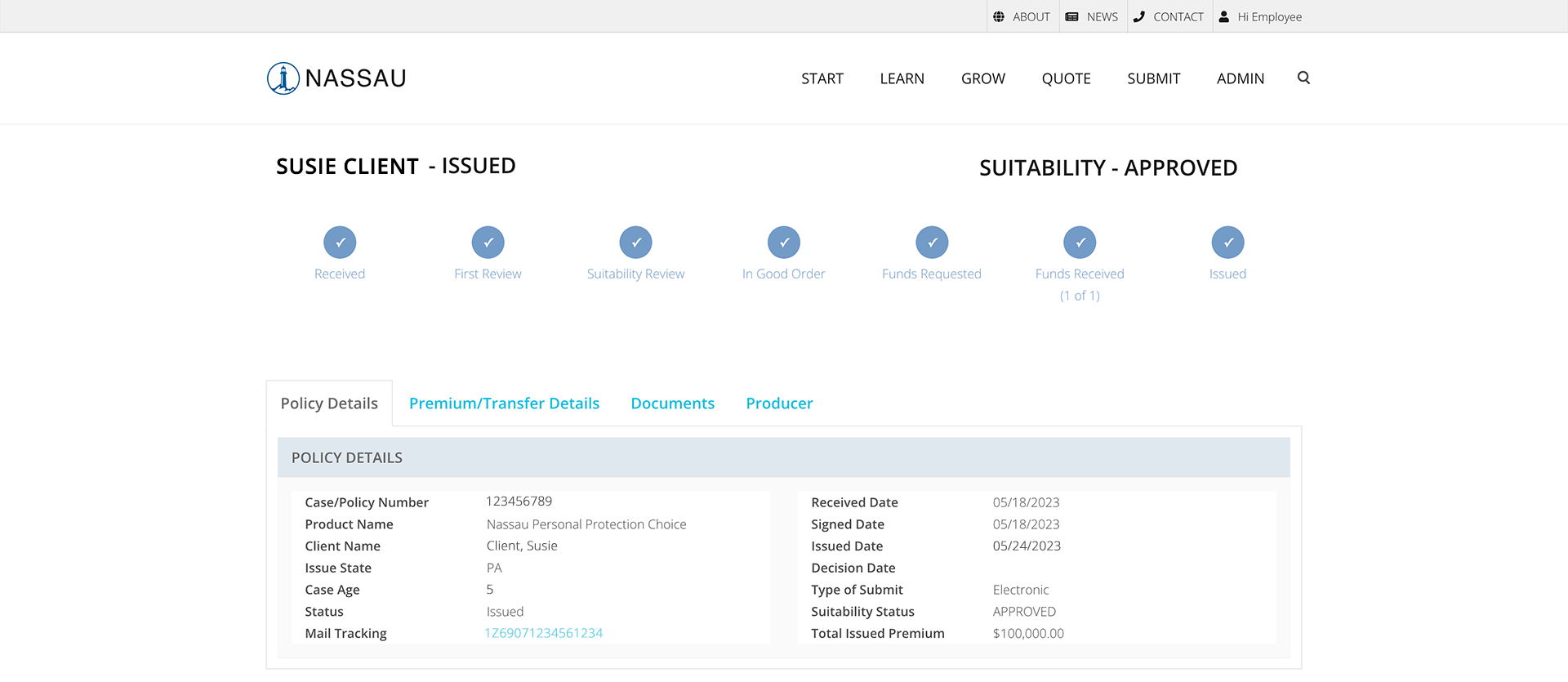

We recently added new data and improved the layout for your Annuity Pending, Issued and Closed information on SalesNet. New features include:

- New progress checklist with at-a-glance status of case milestones

- Detailed log of case manager notes and related email correspondence for Pending cases

- Less scrolling with a tab view of important sections

- Flag indicator for open requirements that require producer action

- New fields like Application Signed Date and Surrender/Guarantee Period

- Quick link to Account Documents for Issued cases

These updates were made based on listening to feedback from producers and back office partners like you. Our goal is to make doing business with us easy and save you time in your day. Keep the feedback coming. We strive to continuously improve your digital experience and are working harder to be your carrier of choice.

As a reminder, you can log in/register for SalesNet to access you Case Status and several other online business tools 24/7 at salesnet.nfg.com.

Questions? Call 800-417-4769 opt 2, opt 1 or chat with us.

Important Details & Disclosures

For IMO/Producer Use Only. Not for distribution to the public.

Products, rider options and other features are subject to state availability. Actual product details, including all terms and conditions that apply, are contained in the annuity contract. Product sales must be appropriate based on a comprehensive evaluation of the customer’s financial situation, insurance needs, and objectives. Guarantees are based on the claims-paying ability of the issuing company.

Nassau, its affiliated companies, and employees do not give fiduciary, legal or tax advice.

Nassau annuities are issued by Nassau Life and Annuity Company (Hartford, CT) except in New York where annuities are issued by Nassau Life Insurance Company (East Greenbush, NY). In California, Nassau Life and Annuity Company does business as “Nassau Life and Annuity Insurance Company.” Nassau Life and Annuity Company is not authorized to conduct business in ME and NY, but that is subject to change. Nassau Life and Annuity Company and Nassau Life Insurance Company are subsidiaries of Nassau Financial Group. The insurers are separate entities and each is responsible only for its own financial condition and contractual obligations. BPD41430

Insurance Products: NOT FDIC or NCUAA Insured | NO Bank or Credit Union Guarantee.

NASSAU SALES NEWS

NASSAU SALES NEWS

Recent Comments